Shipping documents play a vital role in keeping the supply chain moving smoothly and legally in the logistics world. Whether goods are traveling domestically or across international borders, accurate and properly prepared documentation ensures that shipments reach their destination without unnecessary delays or costly errors.

Shipping documents serve multiple critical purposes in logistics operations. They act as legal contracts, provide proof of ownership and transfer, support customs clearance, and help verify the contents and condition of a shipment. From ensuring regulatory compliance to enabling real-time tracking and seamless communication between shippers, carriers, and receivers, these documents are the backbone of efficient, transparent, and accountable supply chain management. Understanding the most common shipping documents—and their functions—is essential for anyone involved in moving goods from point A to point B.

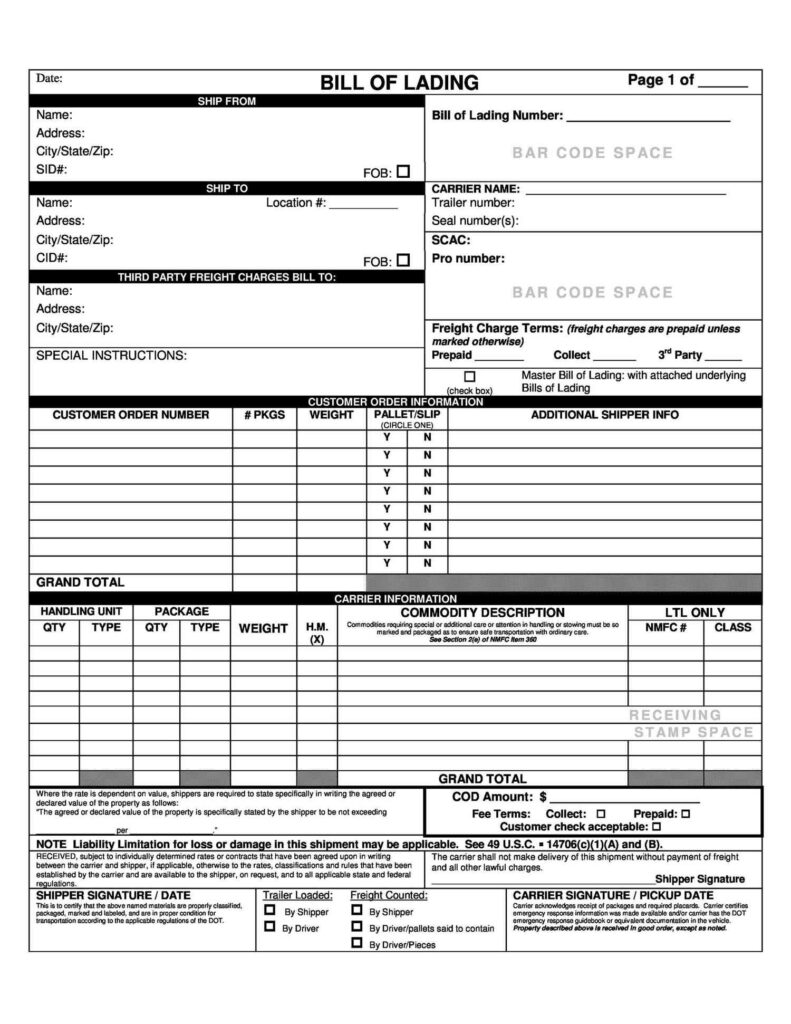

Bill of Lading (BOL)

The Bill of Lading (BOL) is one of the most essential documents in the logistics and shipping industry. It serves as a contract of carriage between the shipper and the carrier, a receipt for the goods, and in some cases, a document of title that can be used to transfer ownership. The BOL outlines key details of the shipment, including the type and quantity of goods, the origin and destination, and the terms of transport.

Types of Bills of Lading

There are several types of BOLs, each suited for specific shipping scenarios:

- Straight BOL – Non-negotiable and used when goods are consigned directly to a specific recipient. The consignee is the only party authorized to receive the shipment.

- Order BOL – Negotiable and can be endorsed or transferred to a third party, commonly used in international trade.

- Bearer BOL – Transferable to whoever holds the document, though less commonly used due to security risks.

- Air Waybill (AWB) – Used specifically for air freight; it’s non-negotiable and functions more as a receipt and transport contract.

- Ocean BOL – Used for sea freight, often required for customs clearance and release of goods at the destination port.

- Inland BOL – Used when transporting goods by road or rail, typically within the same country.

Who Uses It and When It’s Issued

The BOL is prepared and issued by the carrier, freight forwarder, or shipping company at the time the shipment is picked up or loaded for transport. It is used by various parties throughout the supply chain, including:

- Shippers – As a legal agreement and proof of shipment.

- Carriers – As instructions and a record of what they’re transporting.

- Receivers/Consignees – To claim the goods upon arrival.

- Customs Authorities – To verify cargo details and facilitate clearance.

- Banks or Financial Institutions – In cases where payment or letters of credit are tied to the shipment.

Proper handling and documentation of the Bill of Lading is crucial for smooth logistics operations, accurate delivery, and legal protection for all parties involved.

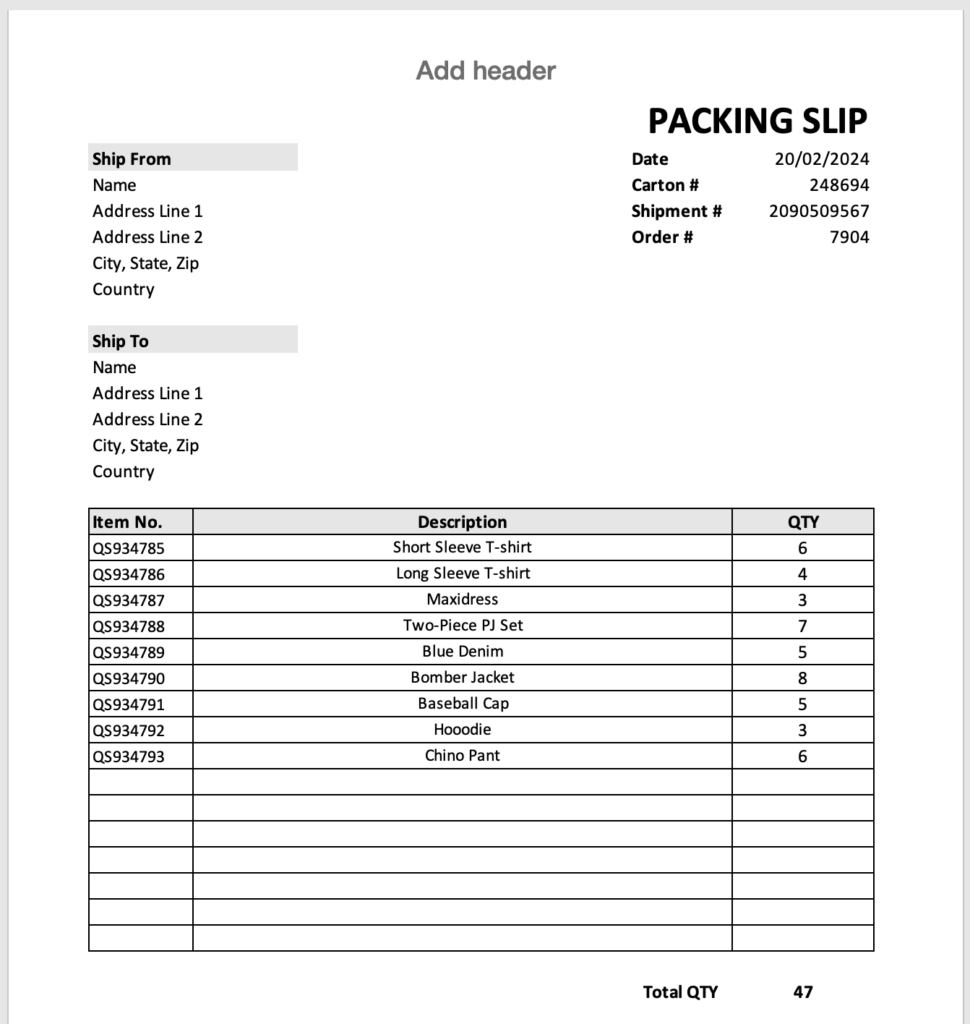

Packing List

A Packing List is a detailed document that accompanies a shipment and provides a complete breakdown of the goods being transported. It includes information such as item descriptions, quantities, weights, dimensions, and how the items are packed (e.g., in boxes, pallets, or crates). Unlike pricing or sales documents, the packing list focuses solely on the physical contents of the shipment rather than the financial or legal terms.

Key Contents of a Packing List:

- Shipper and consignee details

- Invoice number and order reference

- Itemized list of goods (SKU, description, quantity)

- Unit weight and total weight

- Package dimensions

- Type and number of packages (e.g., 5 cartons, 2 pallets)

- Special handling instructions (if any)

Difference from the Bill of Lading (BOL)

While both the Packing List and the Bill of Lading (BOL) relate to a shipment, they serve different purposes:

- The BOL is a legal contract and document of title between the shipper and carrier, outlining the terms of transport.

- The Packing List is an internal document used to detail what is actually inside the shipment. It does not serve as a contract or proof of ownership.

Importance for Warehouse and Customs Verification

The packing list is critical for warehouses, freight handlers, and customs authorities. It allows warehouse staff to accurately receive, inspect, and store shipments, and it helps customs officials verify that the shipment matches the accompanying commercial documents. In international logistics, the packing list is often required for customs clearance, especially when goods are being examined or repacked.

Ultimately, a clear and accurate packing list reduces errors, prevents delays, and improves transparency throughout the supply chain.

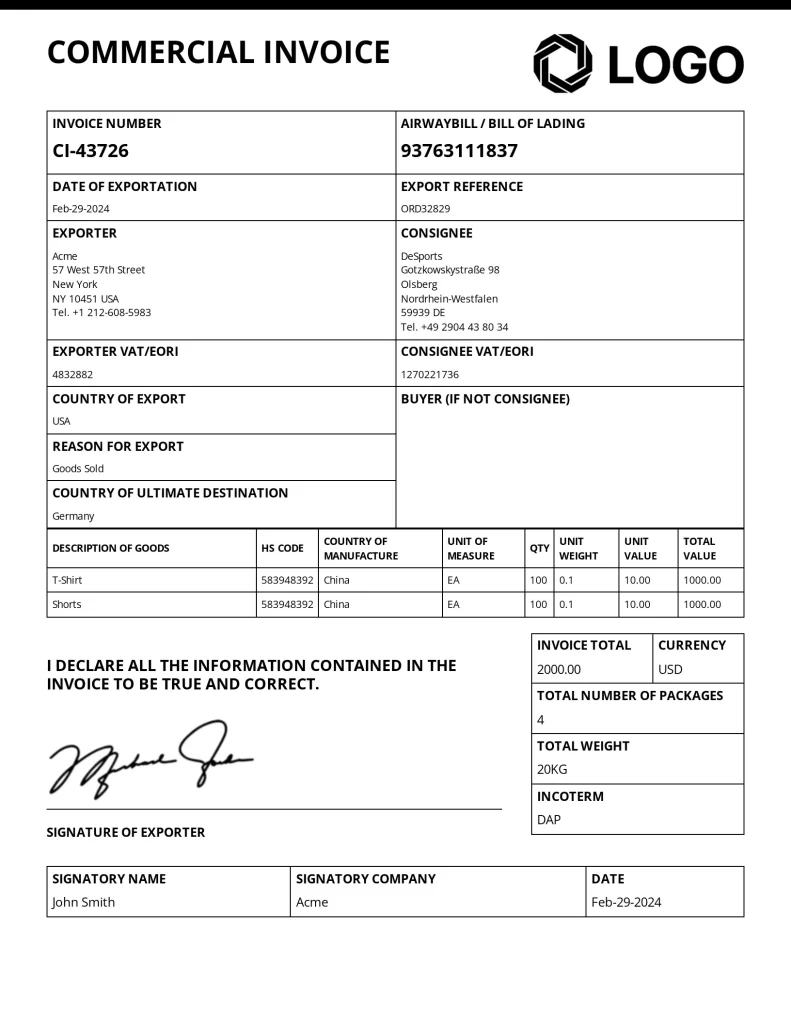

Commercial Invoice

The Commercial Invoice is a key legal document used in international shipping that outlines the sale transaction between the exporter (seller) and the importer (buyer). It serves as a formal request for payment and provides essential information for customs authorities to assess duties and taxes. Unlike a packing list, which details the physical contents of a shipment, the commercial invoice focuses on the financial and contractual aspects of the goods being sold and transported.

What a Commercial Invoice Includes:

- Exporter and importer contact information

- Invoice number and date

- Purchase order or reference number

- Description of goods (including quantity, unit price, and total value)

- HS codes (Harmonized System tariff classification)

- Country of origin of the goods

- Currency and terms of sale (e.g., Incoterms like FOB, CIF, DDP)

- Shipping details (method of transport, delivery terms)

Use in Customs Clearance and Tax Calculation

The commercial invoice is one of the most critical documents for customs clearance. Customs authorities use it to:

- Determine the value of the goods for duty and tax assessment

- Verify the legitimacy and classification of the shipment

- Ensure compliance with trade regulations and import/export laws

Failure to provide a correct and complete commercial invoice can result in customs delays, fines, or shipment rejection. For this reason, exporters must ensure the information is accurate, consistent with other shipping documents, and aligned with the destination country’s requirements.

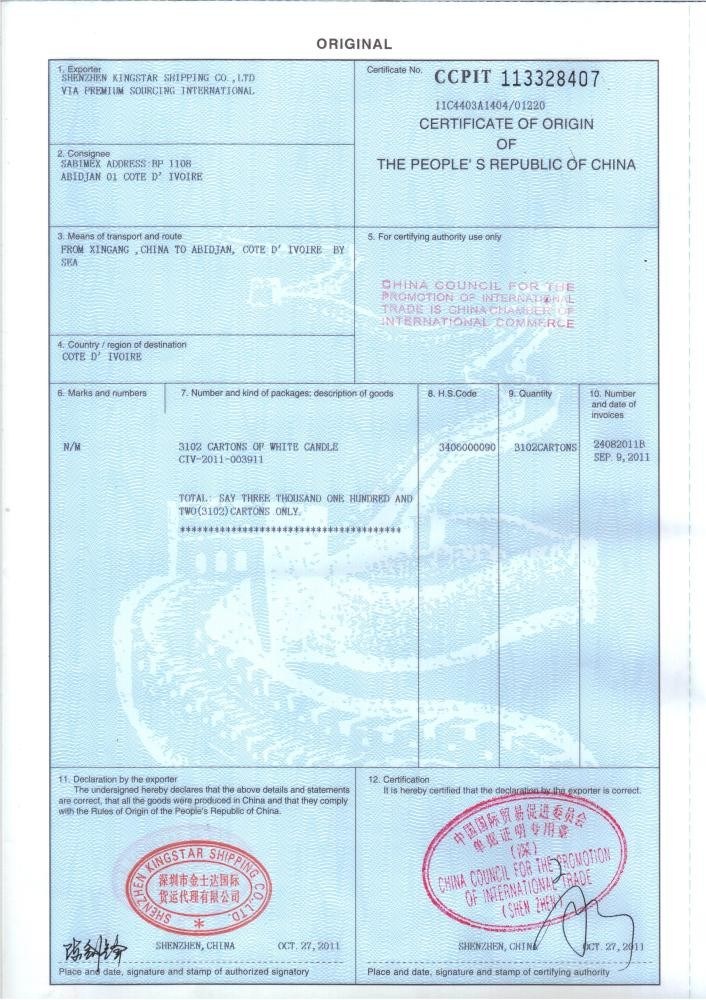

Certificate of Origin

A Certificate of Origin (COO) is an official document used in international trade to verify the country in which the goods were manufactured or produced. This document is crucial for customs authorities, trade compliance, and in some cases, eligibility for preferential duty rates under free trade agreements.

What It Does

The primary purpose of a Certificate of Origin is to confirm the origin of the goods in a shipment. It identifies:

- The exporter and importer

- The destination country

- A full description of the goods

- The country of manufacture or production

This information is essential for determining whether goods qualify for reduced tariffs, import quotas, or are subject to trade restrictions based on their country of origin.

Customs Requirements

Many countries require a Certificate of Origin for customs clearance, especially when the goods fall under specific trade regulations, tariffs, or bilateral trade agreements. Without it, shipments can be delayed, rejected, or subjected to higher duties.

How It Is Certified

Certificates of Origin are typically:

- Prepared by the exporter

- Certified by a recognized authority, most commonly a local Chamber of Commerce or an authorized government agency

- Sometimes electronically issued and verified, depending on the country and platform

The certifying body reviews supporting documents (like the commercial invoice and manufacturing details) to verify the accuracy of the declared origin before stamping and approving the certificate.

Proforma Invoice

A Proforma Invoice is a preliminary bill of sale that is sent to the buyer before the shipment of goods. It serves as a draft document that outlines the goods to be shipped, their estimated value, and the terms of the transaction. While it does not serve as a request for payment, it provides the buyer with essential information needed to make a decision or initiate actions like securing financing or obtaining import licenses.

How It Is Used

The Proforma Invoice is commonly used in international trade for the following purposes:

- Declaration of Value: It provides the buyer with an estimated cost for the goods being purchased, including shipping, handling, and other applicable charges.

- Intent for Sale: It outlines the terms of the sale, such as the quantity, price, payment terms, and delivery conditions, without committing the buyer to full payment or final contract until the goods are shipped.

This document is essential when the buyer is still considering the transaction or needs to secure financial arrangements before proceeding with a final agreement.

How It Helps with Import Licensing and Financing

- Import Licensing: Many countries require a Proforma Invoice to obtain an import license for restricted goods. It helps authorities evaluate the nature, value, and origin of the goods before granting clearance.

- Financing & Letters of Credit: In international trade, a Proforma Invoice can be used by the buyer to secure trade financing or letters of credit. It acts as a reference document for banks or financial institutions to assess the transaction’s value and terms, which is crucial for securing the necessary funds for payment.

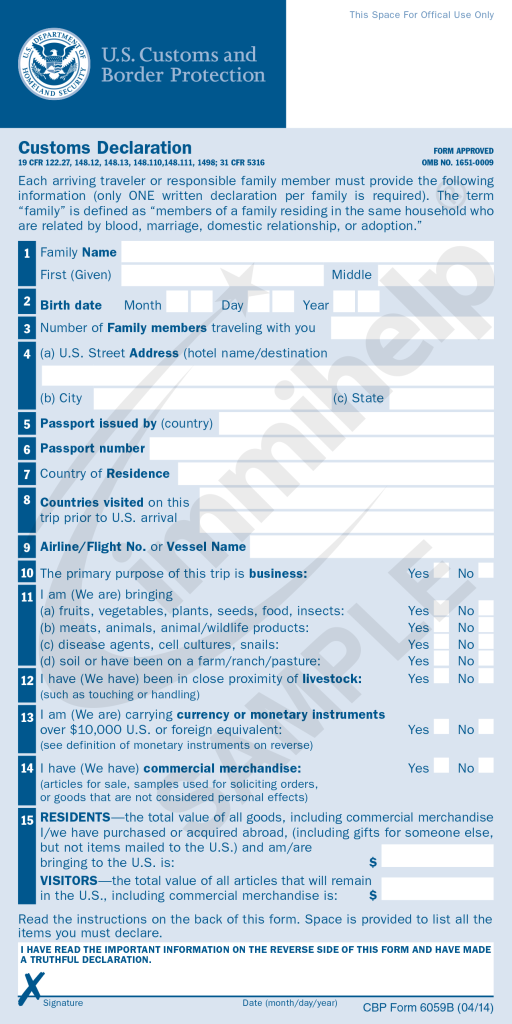

Customs Declaration Forms

Customs Declaration Forms are essential documents required for cross-border shipping that provide detailed information about the goods being imported or exported. These forms are submitted to customs authorities at the border or port of entry to facilitate the clearance of goods and ensure that they comply with both local and international trade regulations. They help customs officers verify the shipment’s contents, determine its value, and assess applicable duties and taxes.

What It Contains

A Customs Declaration Form typically includes the following key information:

- Value of the goods: This is important for calculating the duties and taxes owed upon import or export.

- Weight of the shipment: Helps customs assess the size and potential restrictions on the goods.

- Nature of the goods: Describes the items being shipped, including their classification under the Harmonized System (HS) code, which helps determine applicable duties.

- Country of origin: Specifies where the goods were manufactured or produced.

- Import/export restrictions: Indicates whether the goods are subject to any trade restrictions, such as embargoes or quotas.

How It Helps Assess Duties and Ensure Legal Compliance

Customs Declaration Forms play a crucial role in ensuring legal compliance and facilitating the proper assessment of duties and taxes:

- Duties and taxes: The form provides the necessary information for customs to calculate any applicable tariffs, sales tax, or import duties based on the value, weight, and nature of the goods.

- Trade regulations: The form ensures that the shipment complies with national and international trade laws, such as quotas, sanctions, or licensing requirements.

- Customs clearance: The declaration helps expedite the clearance process by allowing customs authorities to quickly assess the shipment and prevent delays at the border.

Import/Export Licenses

Import/Export Licenses are government-issued documents required for the importation or exportation of certain goods that are subject to regulations or restrictions. These licenses ensure that goods being traded comply with the laws and regulations of the exporting and importing countries. They are typically required for goods that may have security, health, environmental, or economic implications. Without the proper import or export license, shipments may be delayed, confiscated, or face hefty fines.

What It Is

An import or export license is a legal authorization granted by a governmental agency, permitting the shipment of specific goods. The licenses serve to control and monitor the flow of goods that may have national or international implications, such as:

- Military and defense-related goods

- Certain chemicals or hazardous materials

- Agricultural products or food items

- Items subject to import quotas or trade agreements

- Pharmaceuticals and medical devices

These licenses ensure compliance with international trade agreements, safety standards, and national security regulations.

How It Can Vary by Product and Destination Country

The requirement for an import/export license varies by product type and the destination country. Some goods may require licenses regardless of the destination, while others may be exempt or subject to different licensing procedures based on the importing country’s rules. For example:

- Hazardous chemicals or biotech products may require an export license from the seller’s government, especially if they are being shipped to countries with specific regulations or embargoes.

- Agricultural goods, such as livestock or plants, often require import licenses in the destination country to prevent the spread of diseases or pests.

- Medical devices may require special licensing in both the exporting and importing countries to ensure safety and regulatory compliance.

Example of Import/Export License

For example, in the United States, the Bureau of Industry and Security (BIS), part of the U.S. Department of Commerce, issues an Export License for certain goods that are subject to export controls, such as military items or dual-use technologies (products that have both civilian and military applications). A company wanting to export sensitive technology to a country like China may need to apply for and obtain an export license from BIS, depending on the product’s classification under U.S. export control laws.

Insurance Certificate

An Insurance Certificate is a vital shipping document that confirms that the goods in transit are insured against potential risks, including damage, loss, theft, or other unforeseen events. This document serves as proof that the shipper or consignee has taken measures to protect the shipment, ensuring that they are covered financially if something goes wrong during transport.

What It Does

The Insurance Certificate provides the following key information:

- Coverage details: Specifies what risks and types of damages are covered (e.g., damage during loading or unloading, theft, natural disasters).

- Policy number: Identifies the insurance policy covering the shipment.

- Insured value: Indicates the value of the goods covered by the insurance, often based on the invoice value of the items.

- Insurer details: Includes the name of the insurance company providing coverage.

In essence, the Insurance Certificate serves as proof that the shipment is financially protected and ensures that any claims related to damage or loss can be pursued in a structured manner.

Required for Claims in Case of Damage or Loss

If the goods are damaged, lost, or stolen during transit, the Insurance Certificate is required to initiate a claims process with the insurer. The certificate provides:

- Proof of coverage: It confirms that the shipment is insured, making it possible to file a claim for reimbursement.

- Claim validation: The insurance company will typically request the certificate as part of the documentation needed to process the claim.

- Claim payout: Once the damage or loss is verified, the insurer will use the certificate and its terms to determine the appropriate compensation.

What Kinds of Shipping Documents Are Used By Different Types of Shippers?

Different sub-categories of logistics—like hazardous materials, international freight, perishable goods, eCommerce, and domestic trucking—require specific sets of documents to ensure legal compliance, safety, and efficient transport. Here’s a breakdown of common shipping documents by logistics sub-category.

🔁 1. General Freight (Domestic & Non-Hazardous)

- Bill of Lading (BOL) – Core document detailing the shipment.

- Packing List – Lists the items and packaging details.

- Freight Bill – Invoice for the transportation service.

- Proof of Delivery (POD) – Signed confirmation of receipt.

🌍 2. International Freight (Import/Export)

- Commercial Invoice – Used for customs clearance and valuation.

- Bill of Lading / Air Waybill (AWB) – Evidence of contract and shipment terms.

- Packing List – Describes the goods for customs and receiving party.

- Certificate of Origin – Confirms manufacturing country.

- Export/Import Licenses – Required for restricted goods.

- Customs Declaration Forms – Info for duties/taxes.

- Shipper’s Letter of Instruction (SLI) – Instructions for freight forwarders.

☣️ 3. Hazardous Materials (HAZMAT)

- Material Safety Data Sheet (MSDS or SDS) – Chemical and hazard info.

- Dangerous Goods Declaration – Confirms compliance with hazardous transport regulations.

- Emergency Response Info – For transport carriers and authorities.

- Placards & Labels – Physical documentation and visual warnings.

- Special Permits or Handling Instructions – Required depending on substance and route.

❄️ 4. Temperature-Controlled / Perishables

- Temperature Log – Monitors during transit.

- Packing List – Includes shelf life or storage requirements.

- Certificate of Quality / Health Certificate – Especially for food, pharmaceuticals, or biologics.

- Transit Insurance Certificate – Critical for high-value or sensitive perishables.

🛒 5. eCommerce & Parcel Shipping

- Shipping Label – Barcode, destination, and sender info.

- Packing Slip – Customer-facing itemized list.

- Return Label – Optional but common for customer convenience.

- Customs Declaration (CN22/CN23) – For international orders.

🚚 6. Truckload & Less-than-Truckload (LTL)

- Bill of Lading – Includes freight class and NMFC codes.

- Freight Bill – Carrier’s invoice.

- Load Confirmation Sheet – Especially for brokered loads.

- Driver Log / Trip Sheet – Monitors hours and route.

- Weight Ticket – Verifies weight for load compliance.

Frequently Asked Questions – Common Shipping Documents

What is the difference between a Bill of Lading (BOL) and a Packing List?

A Bill of Lading is a legal document between the shipper and carrier that outlines the type, quantity, and destination of goods being transported. A Packing List provides detailed information about the physical contents of the shipment (itemized list, weights, dimensions) but is not a legal document.

What’s the difference between a shipping address and a billing address?

Shipping Address is where the goods are delivered. Billing Address is associated with the payment method and typically matches the address on file with the buyer’s bank or credit card.

Do I always need a Commercial Invoice for international shipments?

Yes, a Commercial Invoice is required for most international shipments. It’s used by customs to determine duties and taxes, and it details the transaction between the buyer and seller.

What is a Shipper’s Letter of Instruction (SLI)?

A SLI is provided by the exporter to guide the freight forwarder or carrier on how to handle the shipment, including routing, documentation, and handling preferences.

What’s the difference between an Air Waybill and a Bill of Lading?

An Air Waybill (AWB) is used for air shipments and is non-negotiable.A Bill of Lading is used for sea, rail, or ground transport and can be negotiable, depending on the type.

Who prepares the Bill of Lading?

Usually, the carrier or freight forwarder prepares the BOL, but the shipper may fill out and submit it, especially in smaller operations.

Why is a Packing List important if the BOL already lists the cargo?

The Packing List helps warehouse teams, customs, and the receiver confirm the quantity, packaging type, and item breakdown—critical for inspections and inventory control.

What happens if there is a mismatch between the commercial invoice and the packing list?

Customs may delay the shipment or issue fines. Consistency across documents is essential to avoid disputes or clearance issues.

Are digital shipping documents legally acceptable?

Yes, in many jurisdictions, electronic shipping documents are recognized legally, especially when using platforms that comply with international standards (e.g., eAWB, eBOL).